Regardless of a rocky begin in August, investor sentiment has remained resilient, with the S&P 500 rallying practically 9% since its August fifth low.

This upward momentum has been pushed by a collection of constructive financial knowledge releases, together with better-than-expected preliminary jobless claims and robust retail gross sales figures.

Wall Avenue additionally reacted favorably to Federal Reserve Chair Jerome Powell’s feedback on Friday, signaling that the Fed is ready to chop rates of interest because the labor market softens and inflation approaches the Fed’s 2% annual goal.

With this bullish surge in play, the important thing query is: how are you going to spot the following scorching inventory on this setting? One efficient technique is to deal with high-upside shares endorsed by analysts from top-tier funding banks like Morgan Stanley. These consultants convey priceless expertise and in-depth data to the desk.

In truth, the analysts at Morgan Stanley have highlighted two shares they imagine are poised for vital beneficial properties within the coming yr – with potential upside as excessive as 220% in a single case. If that’s not engaging sufficient, in accordance with the TipRanks database, each shares are additionally rated as Sturdy Buys by the analyst consensus. Let’s see what’s driving the unanimous reward from analysts.

COMPASS Pathways (CMPS)

The primary Morgan Stanley decide we’ll have a look at is COMPASS Pathways, a biopharma agency growing progressive remedies for hard-to-treat psychological well being issues by leveraging the psychedelic impact of psilocybin. Because the lively compound in ‘magic mushrooms,’ psilocybin has garnered consideration in psychiatric circles for its potential to successfully deal with a variety of psychological well being situations.

COMPASS has developed an artificial psilocybin formulation, generally known as COMP360, designed for use at the side of psychological assist and remedy. The remedy course of entails an preliminary collection of classes the place the affected person and therapist construct rapport, adopted by managed drug administration classes the place the affected person receives psilocybin. Throughout these classes, the affected person is carefully monitored, and post-session discussions with the therapist assist course of the expertise.

Presently, COMPASS’s most superior trial program focuses on utilizing psilocybin to deal with sufferers with treatment-resistant despair (TRD), a extreme psychological well being situation that considerably diminishes high quality of life. The corporate is investigating the COMP360 remedy in two Section 3 scientific trials (COMP005 and COMP006); COMP005 is evaluating the consequences of a single-dose monotherapy in 255 contributors, with top-line knowledge anticipated by This autumn 2024 or early 2025. In the meantime, COMP006 is specializing in mounted repeat dose monotherapy in a bigger cohort of 568 contributors, with top-line outcomes anticipated by mid-2025.

Along with this late-stage research on TRD, the corporate’s COMP360 remedy has additionally been the topic of an open-label Section 2 research within the remedy of PTSD. The research concerned 22 sufferers, centered on security and tolerability, and constructive outcomes had been introduced in the course of the second quarter of this yr. Constructing on these outcomes, the corporate is now evaluating one of the best method to advancing its PTSD remedy.

Morgan Stanley analyst Vikram Purohit, who covers the inventory, sees CMPS as presenting a compelling risk-reward alternative. He highlights the corporate’s main scientific program, stating, “Progress continues with the PhIII program for COMP360 in TRD, the place the following elementary milestone is top-line knowledge from the PhIII COMP005 trial in 4Q24… The PhII knowledge for COMP360 in TRD is aggressive, KOL suggestions on the info and uptake potential for COMP360 is constructive, and the industrial alternative in TRD is well-defined.”

“Primarily based on the info generated & stage of growth for COMP360, CMPS seems considerably undervalued and we discover the chance/reward skewed constructive into knowledge catalysts in 2024/2025 that we imagine might drive vital appreciation in shares,” the analyst added.

To this finish, Purohit charges CMPS shares an Obese (i.e. Purchase), and his $23 worth goal factors towards a sturdy one-year upside potential of ~220%. (To observe Purohit’s monitor document, click on right here)

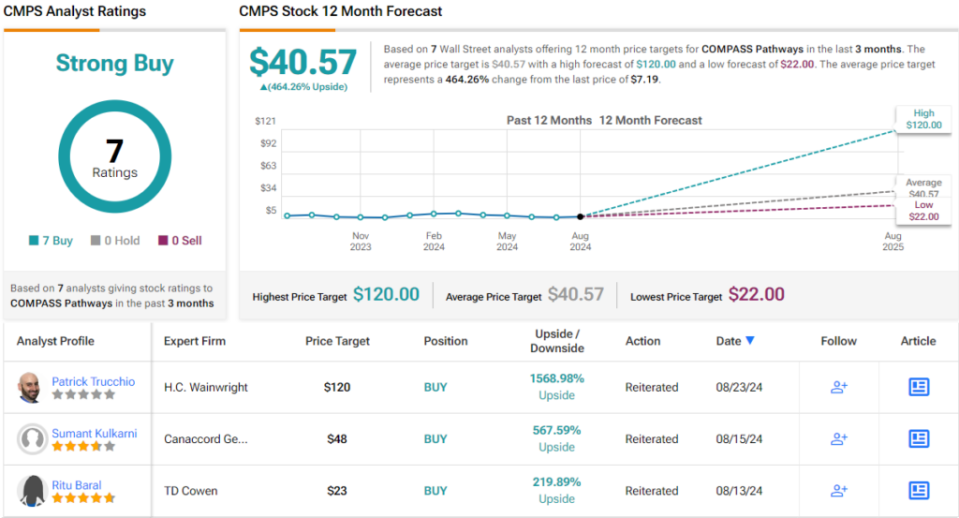

The broader analyst neighborhood shares Purohit’s optimism. Primarily based solely on Purchase suggestions – 7 in whole – analysts collectively charge CMPS as a Sturdy Purchase. With the inventory presently buying and selling at $7.19, the common worth goal of $40.57 implies a powerful upside potential of 464% over the following yr. (See CMPS inventory forecast)

Rocket Prescribed drugs (RCKT)

Subsequent up on Morgan Stanley’s record is Rocket Prescribed drugs, a biotech firm on the forefront of gene remedy. Rocket employs adeno-associated (AAV) and lentiviral (LVV) vectors to pioneer remedies for complicated, uncommon hematologic and cardiovascular situations, areas with vital unmet medical wants and restricted remedy choices.

Rocket’s most superior applications deal with hematology. The corporate is advancing LV RP-L102, a drug candidate designed to deal with Fanconi anemia, and Kresladi, a possible remedy for LAD-1.

On the Fanconi monitor, Rocket just lately launched constructive knowledge from its Section 1/2 research and confirmed that regulatory filings stay on schedule.

Conversely, the corporate confronted a setback in June when the FDA issued a Full Response Letter for the Biologics License Utility for Kresladi, requesting extra CMC data to finish its assessment. Rocket’s administration has assured that the assessment course of is ongoing and that they’re actively collaborating with senior leaders and reviewers on the FDA’s Middle for Biologics Analysis and Analysis to resolve the problem.

On the cardiovascular entrance, Rocket’s analysis applications are progressing nicely. Among the many most outstanding candidates are PR-A501 and RP-A601. PR-A501, a possible remedy for Danon illness, is presently in a Section 2 pivotal research, whereas RP-A601, focusing on PKP2 arrhythmogenic cardiomyopathy, is enrolling sufferers for a Section 1 research.

Rocket’s massive and diverse pipeline has caught the eye of Morgan Stanley analyst Michael Ulz, who is especially impressed by the cardiovascular developments.

“Our Obese ranking relies on Rocket’s place as a pacesetter within the gene remedy area mixed with a sturdy pipeline and skilled administration crew. We view RP-A501 (AAV) in Danon illness as a key driver with blockbuster potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). Whereas we count on deal with the cardiovascular pipeline, we imagine the extra superior hematology (LV) franchise gives close to time period alternative,” Ulz opined.

Ulz enhances his Obese (i.e. Purchase) ranking on RCKT with a $45 worth goal, implying a 142% acquire for the inventory within the coming 12 months. (To observe Ulz’s monitor document, click on right here)

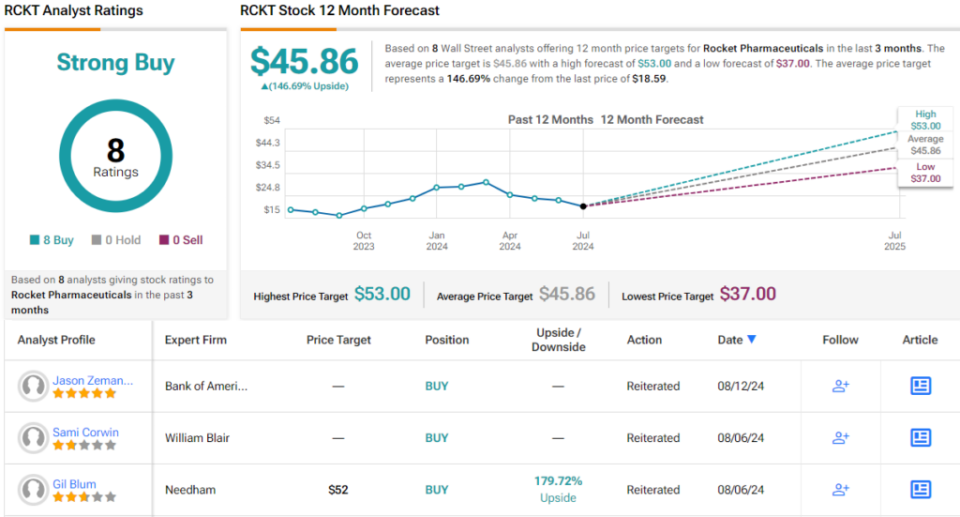

Nobody is arguing with that tackle Wall Avenue. The inventory’s Sturdy Purchase consensus ranking relies on Purchase suggestions solely – 8, in whole. The forecast requires one-year beneficial properties of ~147%, contemplating the common worth goal stands at $45.86. (See RCKT inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.